Though the likelihood of a church being audited is low, churches still must follow IRS guidelines carefully, so it’s important to be familiar with each new year’s changes.

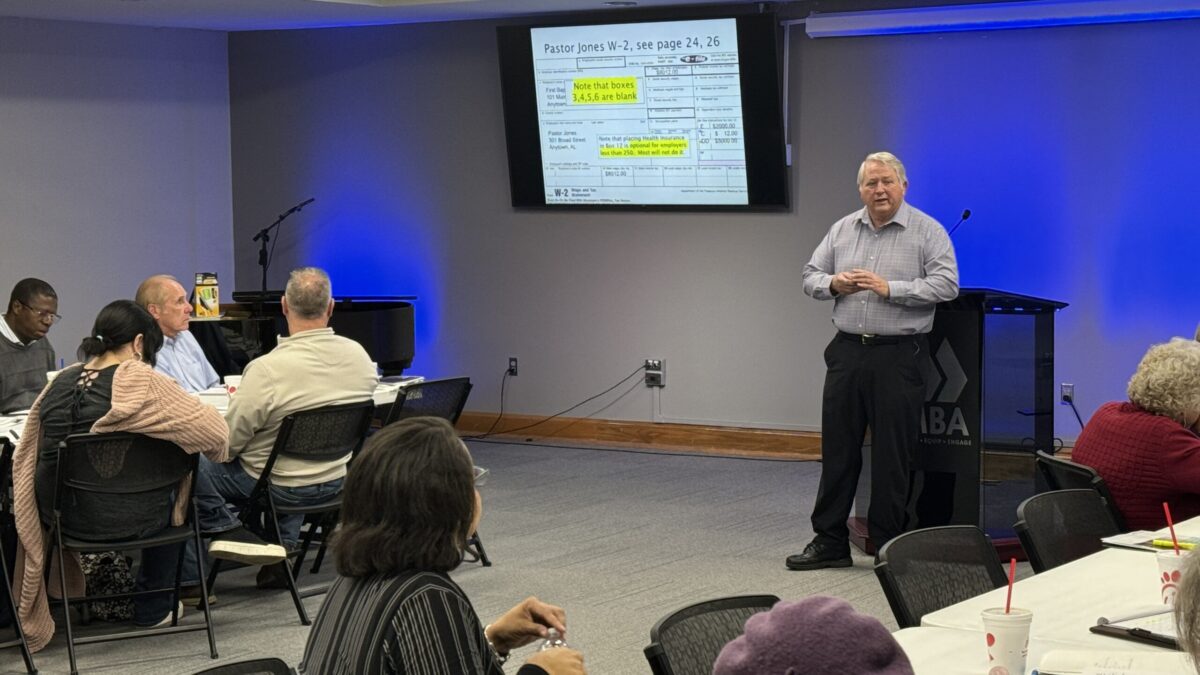

Lee Wright, church compensation specialist for the Alabama Baptist State Board of Missions, directed a church tax conference at the Birmingham Metro Baptist Association on Jan. 11, one of four such workshops he’s offering throughout the state this year.

One new point related to giving is the federal standard deduction for married couples, which rises to $29,200 in 2024.

“Most taxpayers will still itemize for Alabama income tax, but about 95% of taxpayers don’t itemize anymore for their federal taxes,” Wright said.

Wright also reminded attendees that church contribution records must be “contemporaneous.”

“This means that our members should wait until they have the contribution statement in hand before they file their taxes if they plan to itemize,” he said. “I suggest churches declare this in their printed materials in January as a reminder.”

Handling church gifts

Wright said his most often-asked question around the state is about proper handling of contributions.

“Gifts to churches can be cash or property, not gifts of time or labor,” he said. “And these gifts must be given by Dec. 31 to be recorded for the current year. For electronic gifts, the date the donor hits ‘send’ is the date of the gift, no matter if the post date is later. Additionally, gifts must be given without tangible benefit to the donor, and a statement to this effect should be printed on the contribution records provided to members.”

Designated gifts continue to be a special concern.

“The key is church authorization and control,” he said. “This means that the church oversees the designation, and it cannot be for personal benefit of the donor or for a particular individual if the gifts are regarded as deductible for tax purposes.”

Another new item is how long-standing designated funds of 10 years or more can be repurposed.

“Alabama law now offers help in this area,” he said. “If the original intent is impossible, impractical or even illegal and is less than $50,000, the church can vote, seek permission from the original donors, if possible, and send a declaration of intent to the state attorney general’s office. After 60 days, the congregation can redirect the funds for use in similar ministry.”

Gifts also must be substantiated. Wright suggested contribution records be kept for at least seven years and contribution envelopes be kept for two to three years.

Considerations for ministry staff

Wright said churches must be good stewards of all God has given them, including accurate accounting of gifts and disbursements and adequate compensation plans for staff. He said the most confusing issue he’s asked about is a minister’s dual tax status — an employee for federal income tax purposes and self-employed for Self-Employed Contributions Act (Social Security) taxes.

A benefit of the self-employed nature of ministry for an ordained minister is the housing allowance that is not taxable for federal purposes but is taxable for SECA purposes, he said.

The housing allowance should be requested by the minister and approved by the church.

“The average bivocational pastor in Alabama makes about $23,000 according to our study,” Wright said. “It’s conceivable that these pastors could request their entire church salary be designated as housing. The housing allowance should not exceed the fair rental value of the house — furnished — plus utilities. And with a church-sponsored retirement program such as GuideStone, retired ministers can designate part or all of their retirement benefits as housing for further tax savings.”

Wright said most Americans fall short in retirement savings and ministers are no exception.

“The average retirement in GuideStone is around $160,000,” he said. “This sounds like a large amount, but it would generate less than $1,000 each month in retirement. That’s why we recommend the ‘default’ position for the church to be both church contributions and employee tax-sheltered contributions for retirement. This will help employees for many years to come.”

Wright also encouraged churches to be familiar with laws on reimbursable expenses and traditional business expenses as they relate to expenses a pastor incurs during the course of ministry. The reimbursable mileage expense is 67 cents per mile in 2024, Wright said.

Wright offers a number of tax and other financial issues materials at alsbom.org/ccs. He can be reached at 800-264-1225, ext. 2241. His email is lwright@alsbom.org.

Share with others: