As Alabama Baptist church members are forced to tighten their personal financial reins for survival, churches are faced with retaining a vision and means for ministry.

What members do with personal finances affects church ministries, said John MacLaren, director of the office of Cooperative Program and stewardship development, Alabama Baptist State Board of Missions.

“We have found if we can get people in control of their personal finances they are going to do more for the church,” he said.

“We want to teach that stewardship is not to pay budgets but to be obedient stewards, and when we are obedient, the budgets will be met,” he said.

Financial experts agree age and station in life affect giving.

Studies have proven that the majority of charitable givers are from the older generation, while the younger generation, influenced by large debt, consumerism and poor spending habits, generally places church giving lower among its priorities.

In fact, 80 percent of the money given to churches comes from people 55 and older, according to Bobby L. Eklund, author of “Partners with God: Bible Truths About Giving.”

MacLaren said, “Part of the reason is there is not the denominational or individual church loyalty among many younger members that there is among older generations.”

Churches tend to find greater support from the younger generation when they conduct capital fund campaigns because younger people are more likely to give when they can see and touch what they are giving for, he explained.

While the Barna Group reported that the average amount of money given to churches reflected a large increase in 2003 over previous years, others say churches are headed for trouble.

Loren Mead, founder of the Alban Institute and author of “Financial Meltdown in the Mainline,” said, “We are in bad trouble in the churches, and we won’t be out of it in (my) lifetime.”

Mead outlined a list of growing financial challenges for churches, beginning with extensive deferred-maintenance issues, a particular problem for older and larger churches. Churches have put off needed upkeep “because we’ve had a pinch in our budgets for a long time.”

Churches are increasingly being asked to pay taxes, or fees in lieu of taxes, in order to receive city or county services, he said.

A rising number of lawsuits are increasing church liability costs, medical insurance premiums increase annually, demographic shifts often take members away, and competition from other good causes continues to rise.

“Nobody in the church is talking about this,” Mead said. “We think one good year will fix it.” He said churches are so focused on making it through another year that they fail to look down the road to address the next 10 years.

Mead said churches must start training clergy, children and youth to appreciate the importance of giving. Pastors must get over their reluctance to understand and talk about financial matters, he noted.

Annual campaigns should be well planned and administered, Mead said. Regular capital campaigns should be planned to deal with routine maintenance. And systematic planned giving efforts should reach every member.

Baptists in particular need to “get over” their prejudice against endowments and actively encourage members to include the church in their estate planning, he said.

Howard Dayton, founder and CEO of Crown Ministries, said money has a spiritual and practical impact on churches, noting there are 2,350 verses in the Bible that deal with money.

How Christians handle money has a direct correlation to their intimacy with God, he said, because money is God’s major competitor.

Competitor complications arise from consumer debt, which is up 20 percent in the past two years in the United States while savings are down by half, Dayton said. One sixth of Americans will gamble in a casino this year, and the number of bankruptcies could reach 1.6 million, he said.

Meanwhile, charitable giving as a percentage of income continues to decline, and the younger generation is unlikely to reverse it. Adults 35 years old and younger have more debt, less savings and are less generous than any previous generation, Dayton said.

Pastors should talk and teach members how to handle all of their income, not just 10 percent of it, he said. Though pastors may feel unprepared or hesitant to talk about money matters, “teaching God’s people to handle God’s money is a big thing.” (ABP, Anthony Wade contributed)

Church health relies on stewardship

Related Posts

FDA, researchers seek methods of early detection of Alzheimer’s

October 1, 2024

A new blood test could help doctors diagnose Alzheimer’s disease more accurately in a primary care setting, leading to crucial

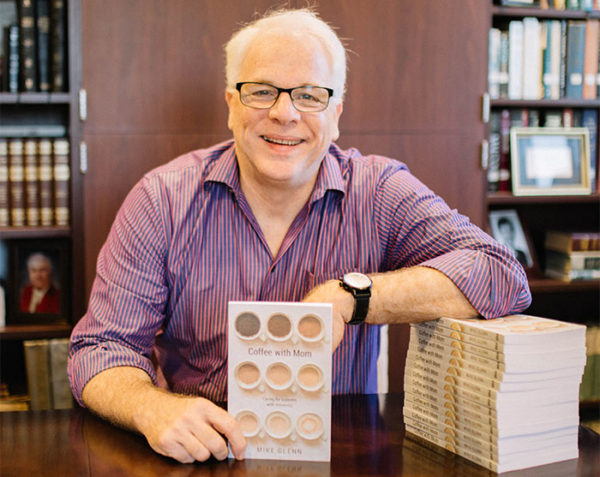

Alzheimer’s, dementia: Pastor shares lessons learned

August 12, 2019

As a minister for more than 40 years, Mike Glenn walked through the valley of dementia and Alzheimer’s disease with

Shame isolates, destroys community, psychiatrist says

October 13, 2016

Nobody needs a psychiatrist to explain what shame feels like — we all know, said Curt Thompson, a noted psychiatrist

Prenatal classes catalyst for new life, faith, churches

January 22, 2015

The young woman gingerly crawls off a motor scooter, grateful for the ride. Before, Kalliyan Seng could make the two-mile

Share with others: