Ninety percent of Americans don’t itemize tax deductions on their federal tax returns anymore, but state filers in Alabama can still take deductions for medical expenses, mortgage interest and other expenses, including charitable contributions to churches, which is one reason reporting those gifts is still very important.

“The IRS gives very specific guidelines for charitable organizations, and churches risk losing tax exemption if they violate these,” said Lee Wright, church compensation specialist for the Alabama Baptist State Board of Missions.

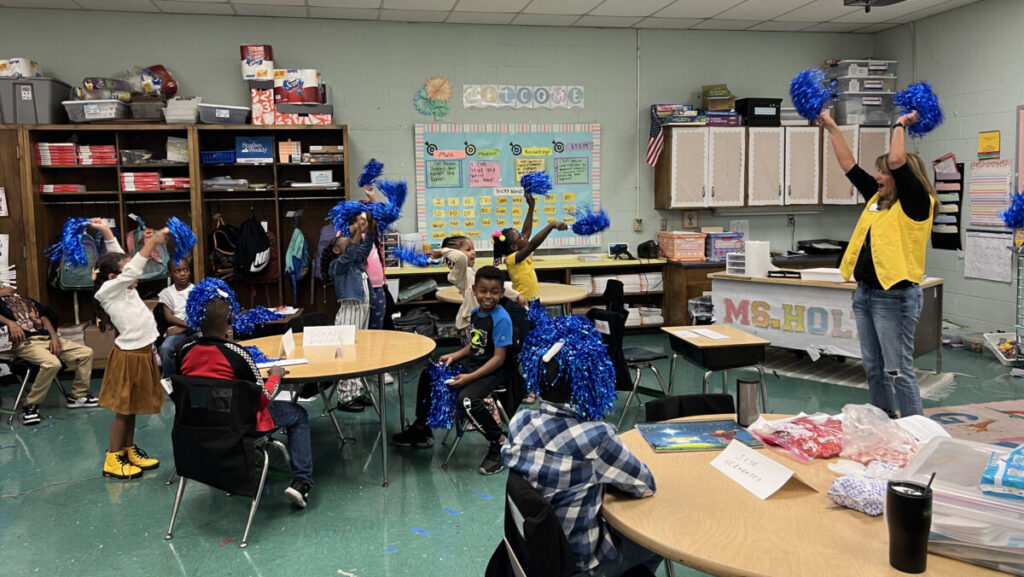

Wright conducted a financial issues conference at the Birmingham Metro Baptist Association on July 12. He said IRS Publication 1828 lists these guidelines.

“Any gifts to the church must be unconditional and without personal benefit to the donor,” he said.

“Gifts must neither inure a church leader nor provide substantial benefit to private interests. ‘Inurnment’ means that an insider, such as the minister, would benefit from gifts, such as an exorbitant salary or gifts of property at below market value. I’ve not known an Alabama Baptist minister with an exorbitant salary, but there was some discussion about this years ago when the CEO of a large nonprofit had a salary of several million dollars. ‘Private interests’ means a vendor or supplier is profiting from gifts to the church, or a for-profit organization uses church property without cost.”

Lobbying efforts

Another prohibition is devoting “substantial part of their activities attempting to influence legislation.”

Wright explained that churches can advocate for moral issues but must not digress to be a lobbying group.

“We support the work of [Alabama Citizens Action Program], and this is fine,” he said. “They lobby for specific legislation on our behalf.”

Another prohibition is that churches cannot endorse or oppose candidates for public office.

“And, of course, churches cannot participate in any illegal activity,” he said.

A special concern is the management of designated gifts. Wright explained that churches must exercise control over such gifts by approving the designation.

“Churches should approve the designation ahead of time and have written policies about designated gifts,” he said. “I suggest the church establish an expiration date so that they can redirect the funds if the ministry project doesn’t happen or the congregation changes its mind.”

Wright said a similar issue is designated benevolence since the church — or the appropriate benevolent committee — must have ultimate control over the funds and permission to use remaining funds for other benevolent needs if the initial need is met.

Other issues

Another issue Wright addressed is proper security for financial records.

“We suggest separate duties for those who handle money and asking local CPAs for guidance on procedures,” he said. “Blank checks, documents and computers must be secure. Electronic banking offers greater security than paper checks.”

Wright said churches continue to have issues with the dual nature of the minister’s tax status.

“An ordained minister is considered an employee for federal income tax purposes, hence a W-2 reporting form, and self-employed for [Self-Employed Contributions Act] tax purposes,” he said. “Churches cannot pay the minister’s SECA taxes, though some churches give an allowance representing the [roughly] 7% they’d pay to regular employees. This is a nice gesture, but the allowance is considered additional income for tax purposes.”

The ordained minister can claim a housing allowance free of federal income tax as long as the amount is no greater than the fair rental value of the home, furnished, plus utilities, he said.

Ordained ministers living in church-owned homes report the fair rental value of the home as income.

Wright said the Tax Cuts and Jobs Act of 2017 raised the standard deduction significantly, hence eliminating the need to itemize deductions for most. But the act also eliminated business deductions — except on Schedule C for self-employment income — such as revivals, Bible conferences, weddings and the like.

“Therefore, a church must have an accountable reimbursement plan or the minister loses money,” he said. “Ministers should turn in receipts for continuing education expenses, books, mileage, meals for overnight trips and the like, and these can be repaid by the church without tax liability for their ministers.”

Wright offers a number of tax and other financial issues materials at alsbom.org/ccs. He can be reached at 800-264-1225, ext. 2241. His email is lwright@alsbom.org.

Share with others: