Beginning June 1, Medicare recipients can begin using Medicare-approved drug discount cards to save money on their prescriptions. Questions about the new cards abound, however, and many experts are advising Medicare recipients to research the cards carefully before making a decision.

Congress passed the Medicare Prescription Drug Improvement and Modernization Act of 2003 in December with the goal of helping Medicare recipients save money on their prescription drug costs. Enrollment for the cards began May 3, and the cards can be used on and after June 1, 2004.

The discount cards are issued by private companies, like insurance and pharmaceutical companies, and offer discounts on specific drugs at specific pharmacies. The cards, which may have a nonrefundable annual fee of up to $30, should provide discounts from 10–40 percent off certain prescription drugs.

Every individual situation is different, so before you choose a card consider the following issues:

Convenience — Can I use this card at a pharmacy that is close to where I live? Remember that if you spend part of the year in a different place, you will want a card that covers pharmacies in both places.

Compare the costs

Covered drugs — Does the card cover the drug I need? If you find that the cards available to you offer a discount on some, but not all, of the drugs you take, you may want to talk to your doctor. Ask him or her if it’s OK for you to switch to drugs that are offered at a discount by the card you want.

Savings — Does the card offer the best price on the drugs I take? The discount offered will vary from card to card, but also from drug to drug on any individual card. What’s more, drugs don’t have standard retail prices like clothing, so different cards could base their discounts on different “list” prices. This means that you have to look carefully at the bottom line price for each drug you take.

Stability — You can only sign up for one Medicare card at a time. Certain exceptions (for example, moving) will allow you to enroll with a new Medicare card, but you will not get a refund for the fee you paid for the first card. Likewise, you may cancel your Medicare card at any time, but once again, you will not receive a refund for the card fee. You must also remember that different cards will offer different discounts on different drugs. And after you pick your card, the private company that provides it can change the covered drugs and/or the discounted prices of drugs as often as once a week. These changes may or may not be publicized or readily available to card holders.

A final word of caution — Fraud is a genuine concern in issues related to financial matters and the elderly. No one should ask you to buy a Medicare-approved card over the telephone or through door-to-door sales. Make sure the card you are considering is on the approved Medicare list before you pay for it, and proceed cautiously with anyone who promises they can get you a “great price” on your medications.

Medicare approves some discount drug cards

Related Posts

Alzheimer’s, dementia: Pastor shares lessons learned

August 12, 2019

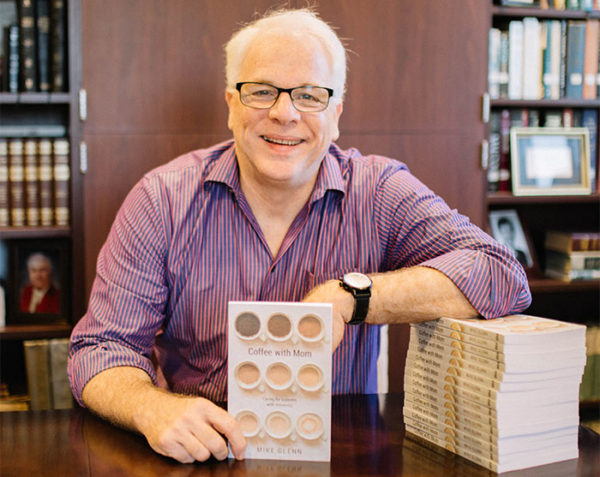

As a minister for more than 40 years, Mike Glenn walked through the valley of dementia and Alzheimer’s disease with

Ministry Tips — Are we the older women?

April 23, 2015

Women’s Minister The Church at Brook Hills, Birmingham As I reached a milestone birthday last year I felt compelled to

Someone You Should Know — Kenneth Stinson

July 17, 2014

Calcedonia Baptist Church, Centre Cherokee Baptist Association Favorite Verses: John 3:16; John 11:35; John 14 Favorite Hymns: “Amazing Grace”; “The

Faith and Family — Grandparents parenting children: Scripture offers encouragement to grandparents raising their grandchildren

January 16, 2014

Almost 5 million children are being raised by their grandparents in the United States today. It is unlikely that any

Share with others: