By Neisha Roberts

The Alabama Baptist

It seems harmless enough — a man borrows a few hundred dollars from a payday loan establishment to help pay for his mother’s funeral expenses. But various things come up and he can’t pay the loan back in time before interest starts accumulating. His car is repossessed and in turn he loses his job.

“A short-term emergency becomes a catastrophic financial situation for that family,” President Barack Obama said during his speech at Lawson State Community College in Birmingham on March 26.

The story is a common one because in reality “most payday loans … are taken out to pay for previous loans,” said President Obama, who’s second visit to the state in March came as the Consumer Financial Protection Bureau (CFPB) outlined a proposal to stop payday lending practices that equate to an “endless cycle of debt.”

CFPB, an agency created in the aftermath of the United States’ financial crisis a few years ago, formed the proposal based on the premise that borrowers should be able to repay their loans and that lending agencies should not lend money if the borrower is not financially stable enough to be able to pay it back.

The proposal rules, which are awaiting approval and revisions, would apply to payday loans but also to vehicle title loans and other forms of high-cost lending, according to news reports.

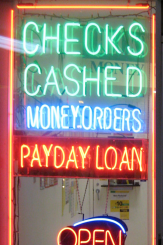

With interest rates above 300 percent in Alabama, and in some cases more than 456 percent, payday loan establishments seem to be poised as guillotines ready to fall on easy prey — low-income families and those already in debt.

And, according to President Obama, there are four times as many payday loan establishments as there are McDonald’s in the state. That makes a statement, the president said, “because think of how many McDonald’s (restaurants) there are.”

Southern Baptists agree something must be done and have been urging action to be taken for almost a year. Resolutions were passed at both the national and state convention annual meetings in 2014.

The Alabama Baptist State Convention resolution focused on combatting “the exploitation of our neighbors through predatory lending.”

‘Warns against … exploiting’

The resolution stated in part that the “Bible condemns gaining wealth through usury and warns against gaining wealth through exploiting the poor.”

The resolution “On Pay Day Loans in Alabama” encouraged state “legislators to pass a bill capping payday and title loan interest rates at 36 percent annually” and encouraged Alabama Baptist churches to “teach their congregations about responsible stewardship and the pitfalls of indebtedness.”

Alabama Citizens Action Program (ALCAP) is another faith-based group that has worked to raise awareness of the dangers of payday loans.

Joe Godfrey, ALCAP executive director, referenced Exodus 22:25–27 and Ezekiel 22:12 as two Scripture passages that encourage the idea that “people ought to be treated fairly.”

And to avoid payday loans Godfrey offered some suggestions.

“Try to find a way to live within your means,” he said. “Whatever income you have or … job you’re able to secure, try to find a way to live on what you’re bringing in and not have to borrow.”

And, he said, “If you do borrow, borrow from a reputable lending institution.”

Godfrey encouraged churches and associations to work together to find alternative ways to help families in need. He also encouraged Alabama Baptists to talk to state legislators and “let them know of their concern about this issue.”

Senate Bill 110, a bill recently filed in the Alabama Legislature and sponsored by Sen. Arthur Orr, R-Montgomery, calls for major reforms to the payday lending industry. If passed the bill would make $500 the maximum loan amount a payday lender could advance to a consumer and would restrict a consumer from taking out more than one loan over a 30-day period. At press time the bill was pending in the Senate.

President Obama said, “I’m proud of the bipartisan effort here in Alabama to try to change (payday lending). They’re not going to have to fight alone. At the federal level … (we will) take steps to help consumers from getting stuck in this level of debt.”

Share with others: