By Michael Smith

Correspondent, The Alabama Baptist

MADISON, Wis. — U.S. District Judge Barbara Crabb has ruled that the federal tax code’s ministerial housing allowance is unconstitutional for the second time.

IRS 26 U.S. Code § 107(2), passed into law in 1954, states that “a minister’s housing allowance (sometimes called a parsonage allowance or a rental allowance) is excludable from gross income for income tax purposes.”

The benefit saves ministers an estimated $800 million annually, according to the latest estimate by the congressional Joint Committee on Taxation.

Crabb wrote in her Oct. 6 ruling, “I adhere to my earlier conclusion that [the minister’s housing exclusion] violates the establishment clause because it does not have a secular purpose or effect and because a reasonable observer would view the statute as an endorsement of religion.”

Crabb, an appointee from President Jimmy Carter’s administration, first ruled the ministerial housing allowance unconstitutional in 2013. But the Seventh U.S. Circuit Court of Appeals in Chicago overturned her decision in 2014, ruling the plaintiffs — the Freedom From Religion Foundation (FFRF) — did not have standing to bring the case.

The FFRF again is a plaintiff in the current lawsuit, arguing that the IRS has violated the Constitution by refusing to permit its leaders to claim the ministerial housing allowance. This time, Crabb ruled that the organization and its leaders have satisfied the appeals court’s requirements to attain legal standing.

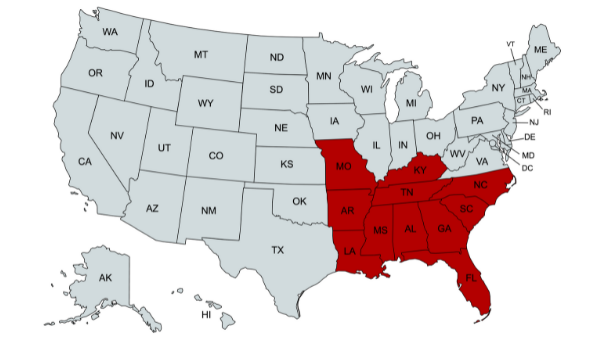

The judge has ordered the parties in the case to submit additional briefing on the form of a final judgment by the end of October. Crabb’s ruling would only apply to pastors in Wisconsin, Illinois and Indiana if upheld by the Seventh Circuit Court of Appeals.

Since no damages or other remedies have been awarded, there is no immediate effect on ministers who are eligible for the housing exclusion under the current law. GuideStone Financial Resources advises ministers to consult the organization’s annual tax guide at GuideStone.org/taxguide and housing allowance information at GuideStone.org/housingallowance to ensure that they are properly documenting housing allowance as part of a church business action and reporting it appropriately on their income tax returns.

Share with others: