GuideStone Financial Resources of the Southern Baptist Convention will make available for 2006 a new qualified high-deductible health plan (HDHP) with an accompanying Health Savings Account (HSA).

GuideStone’s Health Saver 2600 health plan was designed to meet the requirements of a federally qualified HDHP. By enrolling in the Health Saver 2600 plan, eligible employees of Southern Baptist churches and organizations can open an HSA through Highmark Blue Cross Blue Shield.

An HSA is a special tax-advantaged savings account similar to an Individual Retirement Account (IRA) but intended only to be used for medical expenses. This new “consumer-centered” approach to health care is available to people whose only health care coverage is provided through an HDHP like GuideStone’s Health Saver 2600.

Since the deductible is high, establishing an HSA to self-fund out-of-pocket health care expenses may help consumers save money.

“Because the Health Saver 2600 has a high deductible, $2,600 for an individual and $5,200 for a family, you pay a lower monthly rate than you would for a health plan with a lower deductible,” Douglas D. Day, executive officer of benefit services at GuideStone, explained. “As a Health Saver 2600 participant, you can choose to withdraw money from your HSA to pay health care expenses as they incur or you can choose to accumulate funds in the account for future health care needs.”

HSA account holders are able to choose how to invest their account dollars, whether they need ready access to their contributions or want to consider longer-term growth potential. GuideStone participants who open an HSA through Highmark will invest their HSA monies in GuideStone Funds, a family of Christian-based, socially screened registered mutual funds representing virtually every major asset class, style and security diversification.

HSAs provide tax advantages to the account holder. Contributions and earnings are exempt from federal taxes, and distributions are also tax-exempt as long as they are used for eligible medical services. Every year, the money not spent will stay in the account and gain interest tax-free, just like an IRA. Unused amounts remain available for later years; and because the account is owned by the individual — not the employer — an individual can keep his HSA if he changes employers.

To encourage individuals to get preventive care, federal law allows HDHPs to offer “first dollar” coverage for certain preventive care services. GuideStone’s Health Saver 2600 plan pays 80 percent of the cost of eligible preventive care services received from a Blue Cross Blue Shield PPO network provider. Participants do not have to meet the individual or family deductible before the plan begins to pay benefits for these services.

In addition to HSAs, GuideStone also offers Health Reimbursement Arrangements (HRAs). This employer-sponsored arrangement reimburses employees tax-free for eligible health care expenses not covered by the employee’s health plan. This allows employers to transition to lower-cost, higher deductible health plans to save money. By using the HRA to pay a portion of its employees’ increased out-of-pocket expenses, the employer can offset the higher deductible of the plan for its employees.

For more information call 1-800-262-0511 or visit www.GuideStone.org. (GuideStone)

GuideStone offers new health plan

Related Posts

FDA, researchers seek methods of early detection of Alzheimer’s

October 1, 2024

A new blood test could help doctors diagnose Alzheimer’s disease more accurately in a primary care setting, leading to crucial

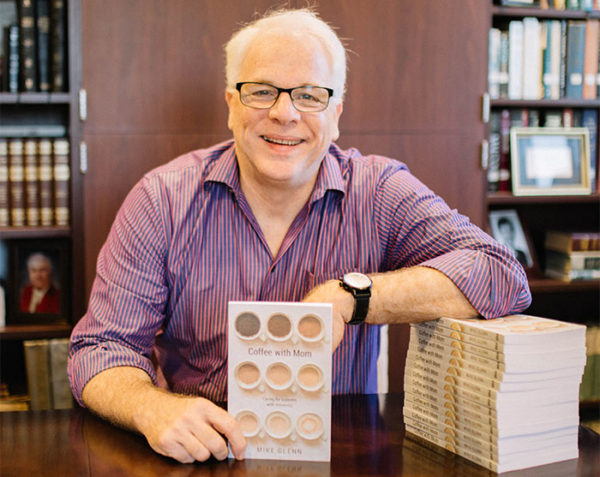

Alzheimer’s, dementia: Pastor shares lessons learned

August 12, 2019

As a minister for more than 40 years, Mike Glenn walked through the valley of dementia and Alzheimer’s disease with

Shame isolates, destroys community, psychiatrist says

October 13, 2016

Nobody needs a psychiatrist to explain what shame feels like — we all know, said Curt Thompson, a noted psychiatrist

Prenatal classes catalyst for new life, faith, churches

January 22, 2015

The young woman gingerly crawls off a motor scooter, grateful for the ride. Before, Kalliyan Seng could make the two-mile

Share with others: